Strategic Partnerships for Resilience: Bagley Risk Management

Strategic Partnerships for Resilience: Bagley Risk Management

Blog Article

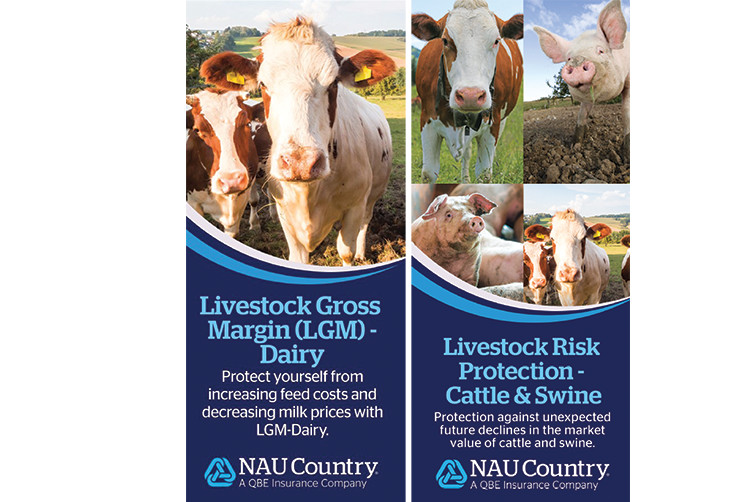

How Livestock Risk Protection (LRP) Insurance Policy Can Safeguard Your Animals Investment

Livestock Danger Defense (LRP) insurance coverage stands as a reputable shield versus the unpredictable nature of the market, supplying a critical method to protecting your assets. By diving right into the details of LRP insurance and its diverse advantages, livestock manufacturers can fortify their investments with a layer of security that transcends market changes.

Recognizing Livestock Risk Protection (LRP) Insurance Coverage

Recognizing Animals Danger Defense (LRP) Insurance policy is necessary for livestock manufacturers aiming to minimize monetary threats connected with cost changes. LRP is a government subsidized insurance policy product made to secure manufacturers against a decline in market costs. By supplying coverage for market value declines, LRP aids manufacturers lock in a flooring rate for their livestock, making sure a minimal degree of earnings no matter of market changes.

One trick facet of LRP is its adaptability, enabling manufacturers to tailor coverage levels and plan sizes to suit their specific demands. Manufacturers can pick the number of head, weight array, protection price, and coverage duration that line up with their production objectives and run the risk of tolerance. Understanding these personalized choices is important for producers to efficiently manage their price risk direct exposure.

In Addition, LRP is offered for numerous livestock types, consisting of cattle, swine, and lamb, making it a functional danger management tool for livestock producers across different sectors. Bagley Risk Management. By familiarizing themselves with the details of LRP, manufacturers can make informed decisions to safeguard their investments and make certain financial stability despite market unpredictabilities

Benefits of LRP Insurance Policy for Animals Producers

Animals producers leveraging Livestock Danger Defense (LRP) Insurance policy gain a strategic advantage in shielding their investments from price volatility and securing a stable financial ground among market unpredictabilities. One essential benefit of LRP Insurance coverage is price protection. By establishing a flooring on the cost of their animals, producers can mitigate the danger of significant economic losses in the event of market downturns. This permits them to plan their budgets better and make educated decisions regarding their operations without the consistent worry of cost changes.

Additionally, LRP Insurance gives manufacturers with satisfaction. Knowing that their investments are safeguarded versus unanticipated market modifications permits producers to focus on other facets of their service, such as boosting animal wellness and well-being or enhancing manufacturing procedures. This tranquility of mind can cause enhanced performance and earnings in the future, as producers can operate with more confidence and stability. In general, the benefits of LRP Insurance policy for animals producers are significant, using a valuable device for handling risk and ensuring economic safety and security in an unpredictable market atmosphere.

Exactly How LRP Insurance Coverage Mitigates Market Risks

Minimizing market dangers, Livestock Threat Security (LRP) Insurance gives livestock manufacturers with a trusted shield versus cost volatility and economic unpredictabilities. By offering defense against unforeseen price declines, LRP Insurance aids producers protect their investments check out this site and keep monetary security when faced with market variations. This sort of insurance policy allows animals manufacturers to lock in a rate for their animals at the beginning of the plan duration, making certain a minimum cost degree no matter market adjustments.

Actions to Safeguard Your Animals Financial Investment With LRP

In the realm of farming risk monitoring, executing Animals Danger Defense (LRP) Insurance policy includes a calculated procedure to guard investments against market fluctuations and uncertainties. To protect your livestock investment successfully with LRP, the initial action is to analyze the details risks your operation faces, such as price volatility or unexpected weather events. Next, it is important to research study and choose a reputable insurance click to find out more service provider that provides LRP policies tailored to your animals and organization demands.

Long-Term Financial Protection With LRP Insurance Policy

Making certain sustaining economic stability through the usage of Livestock Threat Defense (LRP) Insurance coverage is a prudent long-term strategy for farming producers. By integrating LRP Insurance right into their threat administration plans, farmers can guard their animals investments versus unpredicted market changes and unfavorable occasions that might jeopardize their economic health gradually.

One secret advantage of LRP Insurance policy for long-lasting financial protection is the satisfaction it offers. With a reliable insurance coverage policy in area, farmers can alleviate the financial dangers connected with unpredictable market conditions and unanticipated losses due to variables such as illness episodes or natural calamities - Bagley Risk Management. This security allows producers to concentrate on the day-to-day procedures of their livestock business without consistent fret about possible economic troubles

Furthermore, LRP Insurance policy gives a structured strategy to handling threat over the long term. By establishing specific protection degrees and choosing proper recommendation periods, farmers can tailor their insurance policy plans to line up with their economic objectives and run the risk of resistance, ensuring a safe and secure and sustainable future for their livestock operations. To conclude, spending in LRP Insurance is a positive method for farming manufacturers to achieve long lasting monetary safety and shield their source of incomes.

Conclusion

To conclude, Livestock Risk Security (LRP) Insurance coverage is a useful device for animals manufacturers to minimize market threats and safeguard their financial investments. By recognizing the advantages of LRP insurance policy and taking actions to apply it, manufacturers can attain lasting economic safety and security for their operations. LRP insurance provides a safeguard versus rate variations and makes certain a degree of security in an unforeseeable market atmosphere. It is a wise choice for safeguarding animals financial investments.

Report this page